Cash for Clunkers Paves the Way to Retrofit Gas Guzzlers

Summary(View or download this analysis as an eight-page PDF.)Analysis compares two policy options for vehicles already on the road -- 250 million in the U.S. and 900 million globally -- that will continue to burn fossil fuels for decades. Large-scale, properly tuned policies can substantially reduce these vehicles' carbon footprint. Two solutions focusing on older low-efficiency vehicles are scrappage programs, which are gaining increasing support in many countries, and conversions to plug-in hybrids (PHEVs) and all-electric vehicles (EVs), an emerging new option. This paper by the California Cars Initiative, a U.S. NGO, describes the characteristics of conversion architectures and the performance of early prototypes. It also details the results of its analytic model, quantifying projected market penetration of new and converted plug-in vehicles from 2010-2050. It combines this with a second model, based on GREET and other sources, to evaluate these vehicles' potential contributions to reduced oil use and CO2. This model factors in energy used in building vehicles as a percentage of lifetime energy use and evaluates ways to conserve this embedded energy. Derived from these comparisons, a dual strategy combining scrappage of some vehicles, and converting many pickups trucks, SUVs and vans to plug in, emerges as a way to maximize the value of public funds. Two policy initiatives that can together significantly reduce oil use by 2030, and help launch a new global industry in the process -- difficult to achieve solely with new plug-in vehicles -- are:

- to increase government tax and other incentives for certified converted vehicles to match those already in place for new plug-in vehicles

- to apply scrappage in a focused way so that each scrapped vehicle's replacement has at least double its efficiency, and so that instead of crushing them, sound though inefficient vehicles can instead be converted to plug in.

Introduction: Scrappage Expands its Aims

An old idea is coming back -- with a new twist: governments are paying to buy up and recycle or crush old, high-emissions, low-efficiency gasoline vehicles. "Cash for Clunkers" (legislators call them "scrappage") programs, devised to get the dirtiest vehicles off the road, are now also seen as a way to get two more wins: improved fuel-efficiency and boosted new vehicle sales. Both President Obama's Automotive Task Force and the U.S. Congress see this as a lifeline to domestic automakers. Over a dozen other nations have been motivated to develop scrappage programs.

The vehicles already on the road -- 250 million in the U.S. and 900 million globally -- will continue to guzzle fossil fuels and spew carbon dioxide for at least another decade or more. At last, people are realizing that their impact can be lessened. But it will take large-scale, properly tuned incentives. In a broad survey, we explore how scrappage works and consider the implications of current proposals. Then we go a step further, asking, "For some vehicles, might there be a more effective use of a U.S. $3,000 -$6,000 incentive?"

We introduce an innovative, game-changing option, largely unrecognized to date: We can "fix" millions of large gas-guzzlers through retrofits. We show that converting existing vehicles -- especially certain heavy pickups, SUVs and vans -- into plug-in hybrids or all-electric vehicles can avert some of scrappage's unintended market consequences, while saving lots of energy. We demonstrate how much more rapidly plug-in conversions can scale than the expected slow introduction of new plug-in vehicles. In a "best of both worlds" strategy, we suggest that incentives for plug-in conversions can be significantly increased -- and carefully combined with bounties for scrapping vehicles. This way, the world gets a quicker way to reduce greenhouse gases and imported oil, automakers and service companies get a boost, and local communities get green retrofit jobs.

At his March 30, 2009 press conference on the future of the U.S. auto industry, President Obama concluded: "Finally, several members of Congress have proposed an even more ambitious incentive program to increase car sales while modernizing our auto fleet. And such fleet modernization programs, which provide a generous credit to consumers who turn in old, less fuel-efficient cars and purchase cleaner cars, have been successful in boosting auto sales in a number of European countries. I want to work with Congress to identify parts of the Recovery Act that could be trimmed to fund such a program, and make it retroactive starting today." For the new administration, scrappage remains a concept. The President's endorsement has sent policy analysts and economists to the library, as journalists scramble to write front-page stories about a solution that has sufficient design complexity that it's often called a "scheme." The President's comments were a late addition, not included in the report, "New Path to Viability for GM & Chrysler." In this case, Washington has time to make sure the policy is done right.

This paper describes how The California Cars Initiative (CalCars.org), a U.S. NGO engaged in technology development and policy advocacy, views the current landscape -- and the quantum leap that new policies for existing vehicles enable. And it presents the results of new modelling and analysis to show how to maximize the environmental value of funds spent on incentives for plug-in vehicles. To reach a broad audience, this paper is intentionally non-technical, summarizing our studies, with the exception of some projections. The primary documents for analysis are found two spreadsheets in development: Crush or Convert Internal Combustion Vehicles and New PHEV Oil Displacement Projections. Number-crunchers in government, academia and industry can download them to try different assumptions. (This document and the spreadsheets are mostly U.S-centric; we hope to fully internationalize the projections, add metric units, and include other resources (such as water) used in manufacturing and energy production.)

It's imperative to point out that any plan to transform our global fleet rapidly must be supplemented by other ways to reduce the total vehicle miles travelled (VMT) and often inappropriate use of heavy vehicles. Strategies include expanded mass transit and rail freight, smart urban planning and walkable communities, telecommuting and carsharing.

Technology, Emissions and Fuel Efficiency

"Cash for Clunkers" first became popular in the 1990s as a response to air pollution, especially from vehicles built before catalytic converters became available in the mid-1970s. The concept is simple: national or state governments pay owners to retire old vehicles, sometimes only if they buy new or more efficient ones. Scrappage programs promise a policy trifecta: improving average fleet fuel efficiency, reducing air pollution, and spurring demand for new vehicles.

Miles per gallon (MPG) in new U.S. vehicles hasn't improved for decades. Corporate Average Fuel Economy (CAFE) standards remained unchanged for 30 years until 2007. Moreover, they exempted trucks, which encouraged the growth of market share for these most-profitable vehicles. Engineers concentrated on safety and on raising acceleration and power for increasingly heavy vehicles, while neglecting fuel efficiency.

Technology has enormously reduced traditional tailpipe emissions ("criteria pollutants," including particulates, nitrogen oxides, ozone, sulfur dioxides, carbon monoxide and lead). A new 2010 car in California emits 1/200th the smog-forming hydrocarbons of an equivalent 1965 vehicle. Scrapping the oldest vehicles is an extremely effective way to improve air quality. Yet compared to most countries' fleets, vehicles in the U.S. today still have much lower average MPG, higher per capita petroleum use and higher greenhouse gas production.

As long as we have aging gas guzzlers, scrappage can reduce traditional emissions. But our modelling indicates that scrappage reduces CO2 only if each replacement vehicle provides more than twice the fuel economy of the vehicle it replaces. We can attain this through a combination of factors: higher engine efficiency, smaller size and weight, better aerodynamics -- and, most dramatically, by powering vehicles electrically.

Existing Scrappage Programs and Proposals

California, Texas, Illinois and several other states and Canadian provinces have programs to pay $1,000 or more to retire vehicles that meet stated criteria, such as failing smog checks. Europe has many programs; Germany's is widely credited with insulating that nation from declining auto sales. France's has been criticized for "front-loading" demand for replacement vehicles, resulting in later sales declines. Britain has created a program for which any care older than 10 years is eligible.

In the U.S. Congress, H.R. 1550, the Consumer Assistance to Recycle and Save (CARS) Act, offers owners of pre-2001 vehicles $4,000-$5,000 toward the purchase of new higher-MPG cars and trucks (with higher incentives for vehicles assembled in the U.S and for higher-MPG). Both the Detroit automakers and the United Auto Workers support the bill. And there is broad legislative backing for H.R.520/S.247, the Accelerated Retirement of Inefficient Vehicles Act (ARIVA), which offers $2,500-$4,500 to owners of any under-18 MPG vehicle, toward their purchase of higher-than-fleet-average vehicles, manufactured anywhere.

Under both bills, vouchers can alternatively be applied to pay for mass transit. In his endorsement of the general approach, President Obama proposed reallocating funds from other stimulus programs (perhaps from other clean-vehicle funds), which could prove controversial.

Limitations and Effects of Scrappage

Scrappage has often been seen as uncertain and imprecisely targeted, with critics describing it as a potential "sinkhole." Economists report that scrappage programs have caused unintended consequences. There is no boost to automobile production if low-income owners of older vehicles cannot afford high-priced new cars, and instead buy used replacements. (Texas reports this to be the case for 60% of those who turn in cars.)

Used car pricing is destabilized when the resale values of some very old cars get boosted by a scrappage bounty. For example, the value of soon-to-be-eligible old cars can rise and owners may hold onto them longer to gain the scrappage payment. Currently, market prices for relatively recently manufactured used pickup trucks are often under $5,000, lower than some proposed incentives. And some programs inadvertently pay for derelict, or no-longer-used cars.

Analysts warn that any "Buy American" clauses in proposed legislation may violate international trade pacts. (Current non-U.S. programs generally buy back clunkers and incentivize new vehicles built anywhere.) Today, after seven to fifteen years in the hands of their first and second owners, many U.S. vehicles are exported to developing countries. There they remain on the road for an additional 15 years or more -- sometimes with the catalytic converter removed to slightly improve fuel economy. Although they're more out of sight, they still add tailpipe emissions and CO2 to the air we all share. This pattern will continue for vehicles worth more than the crush rate.

The Specialty Equipment Market Association (SEMA) and the Automotive Aftermarket Industry Association (AAIA) represent constituencies ranging from vintage vehicle exhibitors to cash-strapped owners trying to avoid the cost of buying a new car. The AAIA's Fight Cash For Clunkers campaign points out that scrappage destroys hard-to-find spare parts that are impractical to reclaim before or after bodies are crushed. (Notably, the ARIVA bill avoids this problem by requiring that only the engine be destroyed.) Internationally, The European Federation for Transport and the Environment has been a long-time critic of scrappage programs as ineffective and in some cases counterproductive. Its campaign gains strength from the European End-of-Life Vehicle Directive, adopted in 2000, requiring that 85% (95% by 2015) of car parts and materials be recyclable for vehicles built after 2006.

Adding Retrofits to the Mix: First Prototypes

U.S. and international legislators designing scrappage programs have not yet considered that some older, lower-MPG scrappage candidates are still solid, reliable platforms that -- if converted to plug in -- could drive cleanly and cheaply for many years on dramatically less liquid fuel. They don't fully appreciate how long it takes for the fleet to turn over solely from production of new vehicles. They haven't seen evaluations of the energy required to scrap and replace vehicles. We will discuss all these factors below.

To start, legislators (and many others) are unaware of the emergence of small companies demonstrating the feasibility of imaginative alternatives to simple scrappage. Very recently, engineers and entrepreneurs have begun developing custom retrofit solutions for the "low-hanging fruit" – millions of vehicles in popular models that can be affordably modified.

Two pioneering conversion companies focusing on electrification of Ford pickup trucks, the best-selling vehicles in the U.S. for three decades, illustrate the two main design paths for internal combustion engine (ICE) conversions. Both companies have expensive prototypes, and have developed business plans to reach cost-effective pricing ($10-$20,000) in large volumes. See these and other fledgling companies' solutions at Conversions to Electrify the World's 900+ Million Cars.

In one approach, some install an electric motor, battery, and grid charger to supplement the existing engine and create a plug-in hybrid electric vehicle (PHEV). The resulting vehicle has all the original capabilities, while displacing 20-80% of liquid fuel with electricity. (The amount depends on electric range and blending design.) Some PHEV conversions also gain the additional benefit of improved MPG for extended driving. Like most PHEVs, once the batteries are discharged, these operate as standard hybrid-electric vehicles (HEVs). Chicago's Hybrid Electric Vehicle Technologies, Inc. transforms an F-150 that normally gets 15 MPG into a PHEV with a 30-mile all-electric range after each full charge. It then operates until it is recharged as a 21 MPG HEV.

In a second strategy, some retrofitters replace the ICE with a battery and electric motor – plus smaller electric systems for auxiliary functions formerly powered by engine heat or pressure – to create an all-electric vehicle (EV). EV conversions are generally simpler than PHEVs, but they are limited to the driving range of the batteries (which consequently are larger than those in PHEVs). REV Technologies, Inc., in Vancouver turns a Ranger truck into a pure EV with a 50-125 mile range.

Vehicles Eligible for Conversion

Two criteria are the starting point for choosing conversions over crushing. The vehicle's design and available space must accommodate a viable conversion. And its systems must be in condition to run many more years as a plug-in.

Fortuitously, the bigger the vehicle, the easier it is to find space for batteries – and the more fuel can be saved. Former Intel CEO Andy Grove is a vocal advocate of strategically prioritizing the rapid conversion of millions of "PSVs" (Pickups, Sport-utility vehicles and Vans). Many PSVs are can last much longer than the 100,000-200,000 miles of a typical passenger car. Many are built on durable truck frames that are far stronger than those for sedans, and their body panels can be replaced when corroded. If converted to drive electrically, these vehicles, when heavily loaded, can benefit from electric motors' high torque.

Another high-profile PHEV fan, singer Neil Young (in "LincVolt," a forthcoming documentary film) showcases the PHEV conversion of his famously beloved 2.5 ton, 19-foot-long vintage Lincoln Continental. His car illustrates how larger passenger vehicles may have space to accommodate batteries and motor plus the existing ICE for PHEV retrofits. In contrast, smaller vehicles are more likely to be convertible to EVs, where batteries and motors are installed into the spaces formerly used by the engine and gas tank.

Converting large vehicles provides a benefit that is especially unrecognized in the U.S., where the focus on "miles per gallon" ratings skews perceptions the fuel savings. Europeans get it right, looking at "litres per hundred kilometres" (the metric version of "gallons per hundred miles"). With the fraction reversed, it becomes obvious that petroleum displacement benefits are far greater for retrofits of larger vehicles.

For instance, since 2004, by notably transforming 50 MPG hybrids into 100+ MPG PHEVs, CalCars succeeded in building support for PHEVs while demonstrating savings of just one gallon per 100 miles. Compare that to making 15 MPG guzzlers into 30+ MPG PHEVs. That saves almost four gallons per 100 miles -- triple or quadruple the impact per vehicle!

(In the process of developing our analyses, we have developed a useful rule of thumb: for any-size vehicle, with daily driving and recharging, each kilowatt-hour of installed battery capacity displaces 30-50 gallons of fuel/year.)

Of course, we expect retrofits to offer some of the same advances that we anticipate coming for all new cars over time: more efficient engines, part or full compatibility with renewable biofuels, more aerodynamic designs, and use of lighter and safer composites or metals. These improvements are all additive to the primary benefit gained by displacing a significant amount of liquid fuel with cheaper, cleaner, domestically-sourced electricity

Using or Losing Energy

In many cases, converting a vehicle instead of scrapping it makes sense for one more important reason. Our analysis is among the first to seriously explore a second key question: "Every time a vehicle is crushed, how much of the energy used to manufacture it is lost forever?" It turns out that vehicle manufacturing is so energy-intensive that, on average, building one vehicle requires 30,000-50,000 kilowatt-hours of energy. That's over three times the electricity an average natural gas-heated U.S. household uses in an entire year.

It's also 9% of the energy even a low-MPG vehicle consumes in its lifetime. As we make our vehicles more efficient, this "embedded" energy becomes an even larger fraction of its lifetime energy consumption. The energy used to build an EV can be as much as 80% of its lifetime total consumption.

When other options exist, does it make environmental sense to transform the energy required to build a car into little more than waste plus some recycled material? Our modelling shows the answer is "Yes" only if, when looking at the car owner's disposal and purchase transactions, the replacement's fuel efficiency is more than double that of the scrapped one. Notably, this answer is independent of the age of the scrapped vehicle. These considerations are not reflected in scrappage programs or proposals.

Whenever it's possible, converting ICE vehicles to plug in saves both future fuel consumption and embedded energy. For both passenger vehicles and PSVs, using standard industry modelling tools including results from GREET 2.7, we've found that if we scrap an average vehicle and replace it with a similar-sized brand new PHEV, it must be driven 40,000 miles or more before energy savings make up for the energy used to build the new vehicle. Compare that to converting that same existing vehicle into a PHEV. Measuring the energy used in the conversion process and in manufacturing the added components, the energy and CO2 savings begin after just 8,000 miles.

Conversions Can Help End Oil Addiction Sooner

We see a growing national consensus that we have no time to waste in addressing energy security and climate change. Clearly, unless we get more efficient vehicles on the road quickly, we won't have a measurable impact on these problems for decades. How much do scrappage and retrofits help?

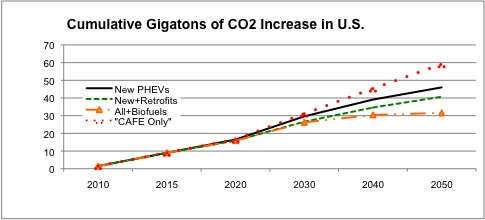

Our modelling focuses on scenarios projecting how rapidly we can gain significant national fleet-wide reductions in fossil fuel consumption and CO2 emissions -- with and without new PHEVs, conversions, other efficiencies, and low-carbon biofuels.

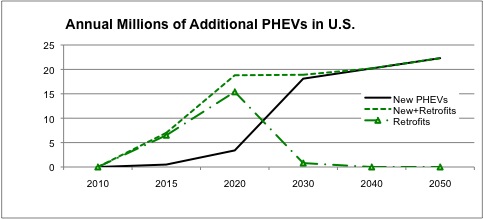

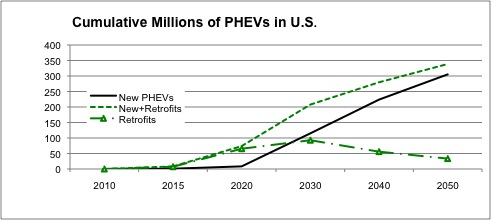

Business analysts talk about "market penetration." In 10 years hybrids reached only 2.4% of new vehicle sales and less than 1% of the total fleet. We see a consensus that this is much too slow. We're encouraged that every carmaker has plans to start selling PHEVs or EVs in 2010-2012. But even if PHEVs arrive at quadruple the hybrid rate, CO2 reductions from vehicles will not reach 15% until 2030. We need reductions much sooner to improve energy security. And because atmospheric CO2 is cumulative, we need early impacts.

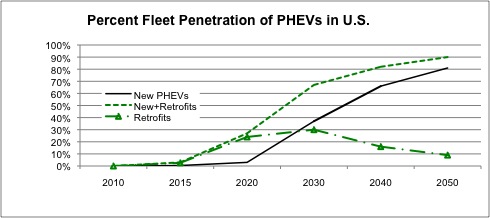

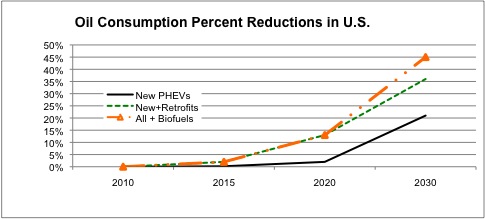

Our numeric projections are worth understanding because they show that to reach significant near-term carbon and oil consumption goals, we must convert existing gas guzzlers. The Obama administration has committed to getting one million new PHEVs on the road by the year 2015. To do this, automakers would have to build 100,000 PHEVs in 2011, then 50% more each year thereafter – over three times the rate of hybrid new-car penetration. The resulting one million PHEVs will be 0.4% of the total U.S. fleet by 2015; only 3% even by 2020; and not until 2030 would 37% be reached. The corresponding reductions in CO2 emissions are approximately 40% of these fleet penetration percentages, still far below needed targets.

A table and charts show some of our high-level results. Our assumptions include the just-described new-vehicle penetration rates. Since the scaling of increased supplies of batteries, motors and power electronics necessary for conversions is attainable, and retrofitting can be done by trained local service technicians, ramp-up can be much faster than for new vehicles. We project 1,000 conversions in 2010 (compared to 100,00 new vehicles that year), increasing annually eightfold (with limitations to accommodate batteries) until 48% of ICE vehicles have been converted.

Note from the "New Plug-Ins: Oil" column that at the rates we can achieve with only new PHEVs, petroleum reduction will be minimal for almost two decades. And we will continue to add to cumulative greenhouse gases at current rates until in 2050 we will have accumulated 46 gigatons -- 5 gigatons more than without the addition of conversions. Nor, due to the research and huge infrastructure requirements, can low-carbon biofuels make a dent until 2030-2040 (see 2010 column and note). However, with conversions, comprising at least 87% of all plug-ins during 2015-2020, 27% instead of 3% of the fleet could plug in by 2020, and 67% by 2030.

Projections for plug-in vehicles with and wihtout conversions

| New Plug-Ins | New Plug-Ins + Conversions | New + Conversions +Low-CO2 Biofuels |

|||||||||||

| Year | Of New | Of Fleet | Oil | CO2 | Gigatons CO2** |

Of Fleet | Oil | CO2 | Gigatons CO2** |

2010 | Oil | CO2 | Gigatons CO2** |

| 2015 | 3% | 0.4% | -0.2% | -0.1% | 9 | 3% | -2% | -1% | 9 | 0% | -2% | -1% | 9 |

| 2020 | 21% | 3% | -2% | -1% | 17 | 27% | -13% | -8% | 16 | 0.2% | -14% | -8% | 16 |

| 2030 | 100% | 37% | -21% | -15% | 30 | 67% | -36% | -25% | 27 | 9% | -47% | -37% | 26 |

| 2040 | 100 | 66% | -41% | -33% | -39 | 82% | -50% | -40% | 35 | 33% | -86% | -76% | 30 |

| 2050 | 100% | 81% | -57% | -51% | 46 | 90% | -61% | -55% | 41 | 33% | -97% | -91% | 32 |

** Cumulative gigatons of CO2 emissions

New plug-ins are not a significant percent until 2025-2030

All near-term oil consumption benefits come from retrofits

After 2030, additional retrofits taper off

Maximum long-term CO2 reduction requires a combination of new vehicles, retrofits and sustainable biofuels

New plug-ins are not a significant percent until 2025-2030

Our conclusion? The fastest ticket to energy security and environmental preservation requires that we take these five simultaneous steps as soon as possible:

- Ensure that most new vehicles plug in

- Retrofit many of the ICE vehicles already on the road

- Incorporate other efficiency measures

- Ramp up renewable low-carbon biofuels

- Increase electricity production from renewable sources

Questions about Retrofit Strategies

Conversion companies and CalCars suggest that tax incentives for retrofitting ICEs be equivalent in scale to incentives for new plug-ins and higher than those for scrappage. Such a proposal will run up against the same objections that new plug-in cars encountered from 2002-2006, which plug-in advocates and experts have been addressing for years.

First, we hear about battery limitations: the technology isn't far enough along; there's not enough lithium to scale production globally; batteries are a recycling challenge. Briefly: batteries are "good enough to get started" and will get better and cheaper much faster with increased demand. Raw materials are ample. Instead of recycling they may be used for stationery energy storage for many years; in any case, nickel and lithium are landfill-safe and can be recycled. Future batteries will use less lithium or entirely different chemistries and designs. (Note: Our projections for adding conversions to accelerate market penetration were designed specifically to require no more battery manufacturing capacity than the new-PHEV-only scenario, though in the conversion scenario the capacity investment occurs sooner.)

Second, we hear that high costs mean there's no business case for retrofits. Even at today's gas prices and with expectations for battery costs similar to those discussed by General Motors and its suppliers for the Chevy Volt, the lifetime total cost of ownership (TCO), including servicing costs and resale value, will be lower for new PHEVs than for ICEs. We expect that high-volume ICE conversions with corresponding public incentives will also show a lower lifetime TCO.

More broadly, calculations rarely account for the externalized costs of fossil fuel addiction. Analysts who include health, environmental and military costs see the real price per gallon of today's petroleum as closer to $10 than $2. Looking ahead, it's likely that the cost of oil will again increase as the global economy recovers and demand from developing countries continues to grow. As this happens, retrofits will prove increasingly cost-effective. And when payback and cost-benefit calculations start from an "end of business as usual" perspective -- factoring in not only external costs of oil, but also likely carbon credits or other results of a cap-and-trade system or a carbon tax -- everything changes.

Finally, we hear doubts that a retrofit infrastructure and component supply chain scale up rapidly enough to convert tens of millions of vehicles. We responded to these concerns above, in describing our assumptions for Table 1. And President Obama, in his March 30 remarks, addressed the general issue when he reminded us of America's Second World War role as the "arsenal of democracy". He evoked what happened in 1942, after Pearl Harbor. President Roosevelt told the auto industry that the nation would stop building cars and trucks -- and shift to making planes and tanks. He asked for 30,000 planes in year one. They said they couldn't do it; then they proceeded to build 120,000. Now we're in a similar moment: the geopolitical, economic and environmental consequences of oil addiction are an equivalent or greater threat. In response, we are now committing to evolving to zero-carbon energy sources as soon as possible -- and we need to power all our cars from those sources.

Let's Do Both: Scrap and Retrofit

Why not include conversion incentives in scrappage proposals? With only a few prototypes to date, it's no surprise that the value of retrofitting ICE vehicles isn't yet recognized. (Readers of this article could play a significant role in changing that!) Yet we do have a foot in the door. The federal stimulus package (H.R.1, The American Recovery and Reinvestment Act of 2009 Section 1141) includes an unprecedented (though still very modest) 10% tax credit of up to $4,000 for converting HEVs and ICEs. When conversions reach high volumes and cost $10,00-$15,000, the 10% incentive will be only $1,000-$1,500. Conversion companies and advocates propose that retrofits that achieve energy savings equivalent to new PHEVs become eligible for equivalent credits up to $7,500. For an industry that's just getting started, incentives will help jump-start small companies' sales -- and encourage large integrators to enter the business.

Today, building awareness and support for conversions is still slowed by the scarcity of prototypes and business plans. We see new companies developing compelling and definitive ways forward. We expect that in the twilight of the Age of Fossil Fuels, many new players will be attracted to the electric vehicle industry and will seek the best ways to convert ICE vehicles.

What will the automotive market look like when we have a successful ICE conversion industry? Here's a look ahead to a possible landscape. Bounties to retrofit PSVs will give owners of gas-guzzlers an attractive way to resuscitate their favorite vehicles. Scrappage programs will require destruction of only the engine, so vehicles can be dismantled for parts or EV conversions.

Conversions of drivetrains into PHEVs via safety-tested, certified kits will often be a preferable alternative to destroying engines. Conversion companies will buy, or accept on consignment, vehicles that owners no longer want. They will partner with used car dealers looking to sell their inventory to an increasingly fuel-conscious public.

It's possible to imagine that in dire economic times, one or more farsighted automakers will scrap old ways of thinking. To gain a revenue stream from vehicles that it sold long ago, partnering with its dealers and one or more conversion companies, an automaker could reach out to existing customers to offer conversions with warranties. Or an even bigger idea: an automaker could get into the business itself as its own "Qualified Vehicle Modifier" (QVM, an industry term for authorized converters).

We might one day see Ford's oldest factory, the Twin Cities Ranger plant in St. Paul (opened in 1924 and now on life support until 2011), reborn and building new plug-in Ranger trucks, with a second line converting the region's old trucks! City and state officials and UAW Local 789 have already said they're open to anything that keeps the factory open and workers on the job. Such a plan could emerge from any company and community with an automotive factory.

In the future, we may see lightweight and affordable in-wheel electric motors, and much higher density batteries. Such welcome "breakthroughs" are not needed to get started with conversions of large vehicles. However, they will eventually make conversions feasible for even small passenger sedans, turning them into 100-300 mile range EVs. At that point, the number of vehicles that it makes sense to crush instead of convert will diminish significantly. We will become the ultimate vehicle recyclers. And that spectacular moment in Goldfinger, familiar to any James Bond fan, when a Lincoln Continental became a three-foot cube, will remind us of a vanishing era.

Converting as many of our current vehicles as possible can become a giant business opportunity. And it presents us with a global choice. We can wait for new efficient vehicles to slowly replace our gas guzzling fleet. This means that for over a decade, we will see mainly symbolic effects on the global challenges we aim to address. Or we can take effective steps to more rapidly reduce both our fossil fuel use and our contribution to greenhouse gas emissions, while at the same time adding new green jobs and reducing driving costs. Moving forward with conversions brings many benefits. Delaying only increases global risks.

Acknowledgments

This article is a collaboration of CalCars.org's Founder Felix Kramer; Technology Lead Ron Gremban; Director of Projects Carol DiBenedetto; Senior Advisor Randy Reisinger; and Volunteer Remy Tennant, an MBA student at San Francisco State University. [Disclosure: the principal author is an advisor to both Hybrid Electric Vehicle Technologies, Inc. and REV Technologies, Inc.]

The California Cars Initiative is a Palo Alto-based nonprofit startup of entrepreneurs, engineers, environmentalists and consumers promoting 100+MPG of gasoline (plus a penny a mile of electricity) PHEVs. CalCars is itself a hybrid, focusing both on public policy and technology development, and harnessing fleet and individual buyer demand to help commercialize PHEVs. The increasingly-successful effort is becoming recognized as a hopeful sign we can get off our addiction to fossil fuels. This may be the first time a high-ticket consumer product will be mass-produced and come to market as the result of a "bottom-up/by popular demand" campaign. This could provide a model to be applied in other sectors of society where we need to develop no-petroleum, zero-carbon products.